The Planning Process

Define your charitable objective: | Identify where and how you want to make a difference. Decide how involved you (and your family members and advisors) want to be in making grant.

Determine your financial objective: | Are you looking for any tax or estate planning benefits? If so, we can help you with information about the advantages of different types of gifts so that you can fit your philanthropy into your financial plans.

Create or Contribute to a Fund: | We will work with you to create a fund that meets your objectives. Or, if there is an existing fund that meets your needs, your contributions will not require a new fund agreement.

Start a Fund Now

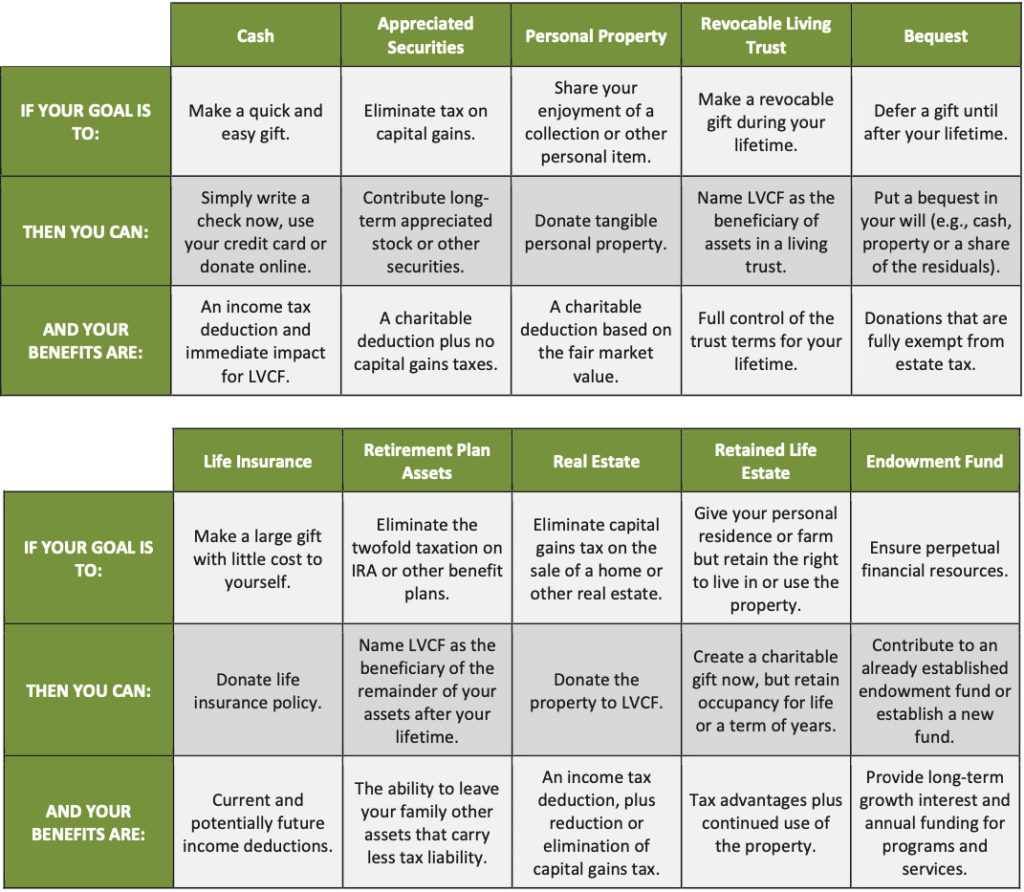

Creating a named charitable fund at the Community Foundation is simple and is often a one-step process. After deciding what type of fund (see below) would best serve your interests, you can determine the contribution type that would be most convenient and advantageous for you. In general, your fund may be created by an outright (current) gift, or by a planned.

Find the Gift Options that Meet Your Goals

ASK CARRIE | If you would like to find out how to make your charitable giving easy, local, and impactful contact Carrie.

Carrie Krug Nedick, CAP®

Director of Donor Services

840 West Hamilton Street, Suite 310, Allentown, PA 18101

610 351-5353 Ext. 10 | carrie@lvcfoundation.org