Community Foundations | the best choice for your charitable giving

The Lehigh Valley Community Foundation offers an alternative to the expense and administrative burden of creating or maintaining a private foundation. The Foundation’s EverGreen Fund is the perfect alternative to starting or maintaining a private foundation.

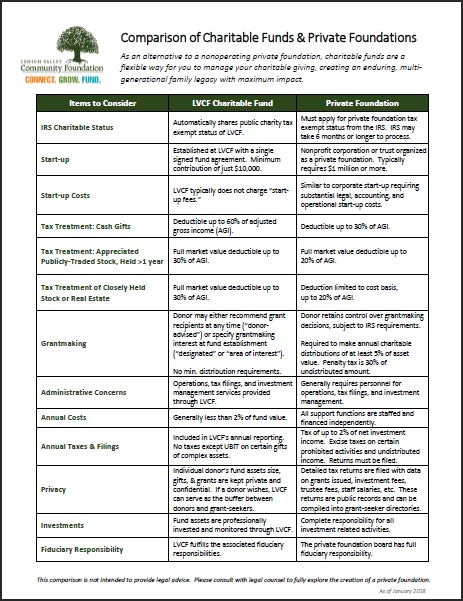

An overview of the similarities and differences between a private foundation and a fund at the Community Foundation is illustrated in the following document:

Comparison of Charitable Funds & Private Foundations | PDF

Internal Revenue Code Section 507 permits termination of a private foundation and the distribution of its assets to a qualified public charity, such as the Lehigh Valley Community Foundation (LVCF). LVCF welcomes the transfer of private foundations. There are various reasons as to why it’s necessary to terminate a private foundation and LVCF can assist in the process.

ASK Maureen | Ask me how the Community Foundation can help you and your clients create a lasting legacy and make a difference in the community….

Maureen Connolley Wendling

Director of Donor Initiatives

Lehigh Valley Community Foundation

810 W. Hamilton Street, 310, Allentown, PA 18108

610 351-5353 or email: Maureen@lvcfoundation.org